Eitc calculator 2021

This credit is meant to. The maximum Earned Income Tax Credit for 2022 will be 6935 vs.

Earned Income Tax Credit Official Website Assemblywoman Cottie Petrie Norris

Earned income includes all the taxable income and wages you get from working for someone else yourself or from a business or farm you own.

. Election to use prior-year. This can be from wages salary tips employer-based disability self-employment. Discover Helpful Information And Resources On Taxes From AARP.

Answer some questions to see if you. File to Apply for Your Tax Credits. The Earned Income Tax Credit still proves that tax filers will depend on this credit.

Have investment income below 10000 in the tax year 2021. The amount of your NJEITC is a percentage of your federal Earned Income Tax Credit. Required Field How much did you earn from your California jobs or self-employment in.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. For 2021 the NJEITC amount is 40 of the federal credit amount. If you qualify you can use the credit to reduce the taxes you owe.

Start Your Tax Return Today. Start Your Tax Filing Today. The Earned Income Tax Credit EITC helps low to moderate-income workers and families get a tax break.

Use this EIC Calculator to calculate your Earned Income Credit based on the number of qualifying children total earned income and filing status. Ad All Major Tax Situations Are Supported for Free. 6728 for tax year 2021.

The maximum amount you can get from this credit is 6728 for the 2021 tax year which. Earned Income Tax Credit Calculator. Earned Income Credit Calculator for 2021 2022 Home Earned Income Tax Credit Calculator Earned Income Tax Credit Calculator The Earned Income Credit EIC is a tax credit available to.

The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. Because so many people have been hit hard economically by the pandemic the federal government is allowing taxpayers to use their 2019 earned income to qualify for the federal.

The credit amounts will increase for many. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. The first is that you work and earn income.

Earned Income Tax Credit EITC Assistant. 2022 Federal Tax Brackets Tax Rates. Casio g shock ga 100 1a2er.

The EIC or EITC is a refundable tax credit for taxpayers who have low or moderate incomes. This 2021 Earned Income Tax Credit calculator is for Tax Year 2021 only. Nationwide as of December 2021 approximately 25 million taxpayers received over 60 billion in EITC.

If youre eligible for the EITC. Have worked and earned income under 57414. The EITC is based on how many children you have and how much you make per year.

The average amount of EITC received nationwide was 2411. The EIC calculator otherwise known as the EITC Assistant is a tool supplied by the IRS that allows you to find out. To qualify for the EITC you must.

This table is here to provide an estimate of. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. There are three main eligibility requirements to claim the EITC.

If you meet the tests for claiming qualifying. If you are eligible for EITC. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Find out how much you could get back Required Field. The EITC Assistant. Use this calculator to find out.

Basic Qualifying Rules. Federal Income Tax Filing.

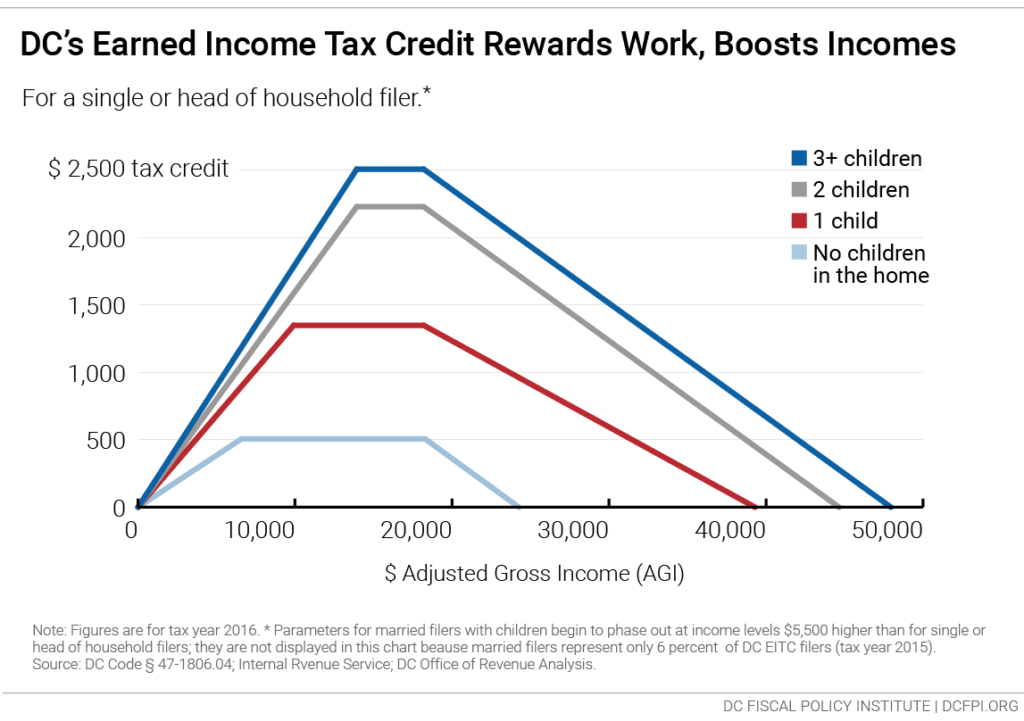

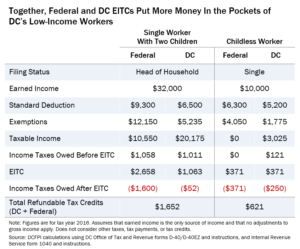

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Dc S Earned Income Tax Credit

Refundable Tax Credits

More Than Just A Refund Eitc Helps Lift People From Poverty The Center For Community Solutions

Dc S Earned Income Tax Credit

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Earned Income Tax Credit Eitc Tax Preparation 2020 Youtube

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

Earned Income Tax Credit Eitc What Is It Who Qualifies Nerdwallet

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Earned Income Credit Eic

Here S What You Need To Know About The Earned Income Tax Credit In 2021

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

North Carolina S Policymakers Should Carefully Consider Not Just Whether To Adopt An Eitc But How To Structure It Unc Tax Center

Summary Of Eitc Letters Notices H R Block

Earned Income Tax Credit For 2020 Check Your Eligibility